( 5 min )

The most basic and popular loans that you may encounter when you start your career in banking may include:

- Personal Loans

- Home Loans

- Gold Loans

- Vehicle Loans

Let us understand the features, eligibility criteria, etc associated with these loans.

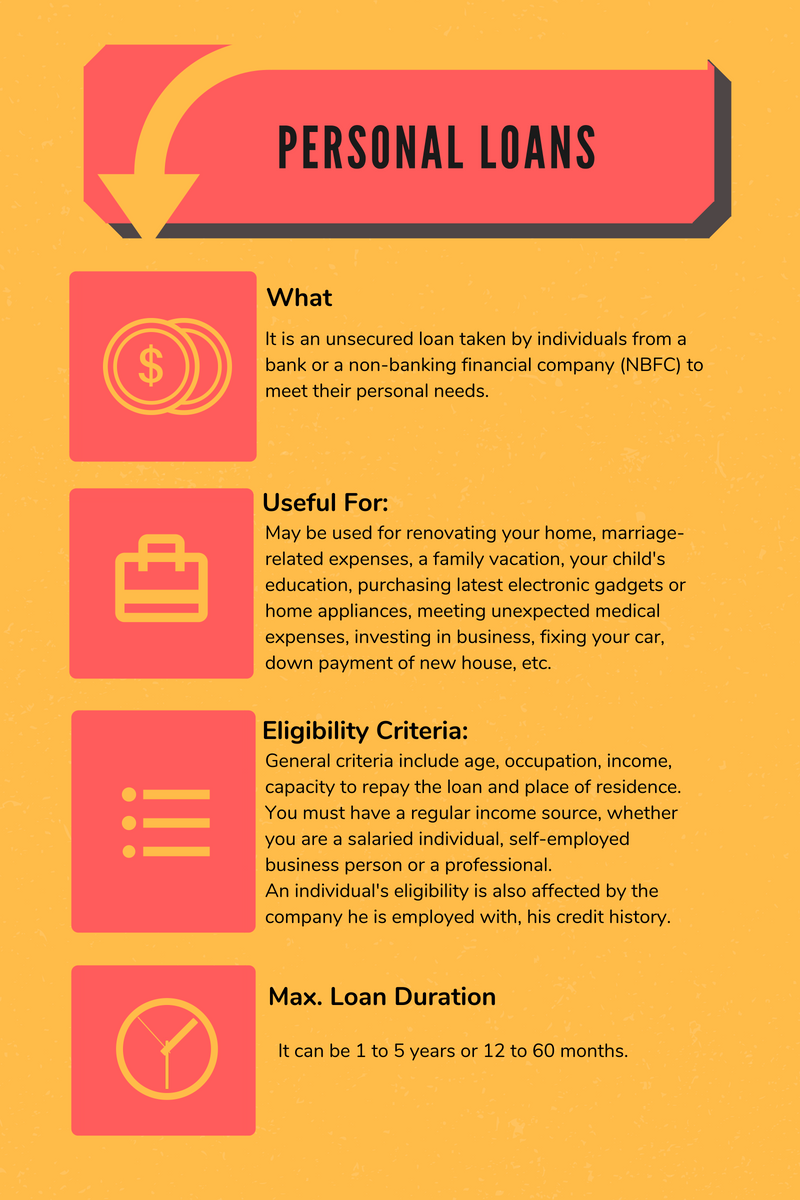

Personal Loan

An increasing number of consumers are now taking personal loans for their purchases, especially the big-ticket ones. They are also converting their purchases into equated monthly installments (EMIs). Personal loans help the households meet any shortfall they experience in buying a house or a car, in children's higher education, or even in cases of medical contingencies, among other things.

Here's a low down on personal loans to understand them better.

What is a personal loan?

Simply put, it is an unsecured loan taken by individuals from a bank or a non-banking financial company (NBFC) to meet their personal needs. It is provided on the basis of key criteria such as income level, credit and employment history, repayment capacity, etc.

Unlike a home or a car loan, a personal loan is not secured against any asset. As it is unsecured and the borrower does not put up collateral like gold or property to avail it, the lender, in case of a default, cannot auction anything you own. The interest rates on personal loans are higher than those on home, car or gold loans because of the greater perceived risk when sanctioning them.

However, like any other loan, defaulting on a personal loan is not good as it would reflect in your credit report and cause problems when you apply for credit cards or other loans in future.

What can it be used for?

It can be used for any personal financial need and the bank will not monitor its use. It can be utilised for renovating your home, marriage-related expenses, a family vacation, your child's education, purchasing latest electronic gadgets or home appliances, meeting unexpected medical expenses or any other emergencies.

Personal loans are also useful when it comes to investing in business, fixing your car, down payment of new house, etc.

Eligibility criteria

Although it varies from bank to bank, the general criteria include your age, occupation, income, capacity to repay the loan and place of residence.To avail of a personal loan, you must have a regular income source, whether you are a salaried individual, self-employed business person or a professional. An individual's eligibility is also affected by the company he is employed with, his credit history, etc.

Maximum loan duration

It can be 1 to 5 years or 12 to 60 months. Shorter or longer tenures may be allowed on a case by case basis, but it is rare.

Source: This Article.

Home Loans

A Home Loan is a secured loan product where the lender provides finances for the purchase or construction of a residential/commercial property. One can also avail a housing loan to buy a plot of land and construct on it. Home Loans are also issued to extend/ repair/ renovate/ alter a new or second-hand property. The Home Loan is taken by a borrower against the property/security to be bought. This is done by giving the banker a conditional ownership over the property i.e. if the borrower fails to pay back the loan, the banker can retrieve the lent money by selling the property.

Most lenders get the property valued independently and provide loans based on their estimated value. It is important to remember, however, that frequently their valuation is significantly lower than the actual cost and hence the requirement of the borrowers goes up. Home loans in Indian Banks are provided up to maximum of 80% (90% for loan amount below INR 20 lakhs) of the value of the house. Home loans are repaid using Equated Monthly Installments (EMIs) spread over a fixed tenure.

Home Loan Eligibility Criteria:

Home Loan eligibility depends upon various factors. A few of them are listed here –

Income – Your income determines the amount of home loan you are eligible for. Banks generally keep the EMI to income ratio at 0.45 to 0.50.

Tenure – The longer tenure you opt for, the more is your home loan eligibility and the lesser is your EMI.

Age – Your age will determine your home loan tenure and hence your eligibility.

Interest Rate offered – Banks offer Fixed and Floating Rates of Interest. If your interest rates are on a lower side, then the loan eligibility will be higher..

CIBIL Score – Your credit report tells the bank about your repayment capacity and hence determines if you’re eligible for a loan.

Source: This Article.

Gold Loans

If you’re looking for an easy and quick way to get financing, a gold loan is just what you need. Now you can take the loan against gold ornaments and get relieved of your immediate requirements. While your gold stays safe in a vault, you can go ahead and take advantage of every opportunity.

While other loans require income or salary proofs and several other documentation, to avail a gold loan all you need is gold over 18 carats. The loan amount is dependent on the value of the gold and is guided by the regulations of Reserve Bank of India. Your gold is insured and is stored in fire and burglary proof vaults.

There are many banks and loan firms that give gold loans to those who need them.

Vehicle loans

In a period of continued price rise, saving up for months and years to buy a car is indeed a tough task. In this situation a car loan is one borrowing instrument that scores high with the average middle class Indian as cars are nothing short of a necessity. This rising demand has led to the emergence of attractive loan offers from numerous banks and financial institutions, such that, you are spoilt for choice. The following are some key facts you need to keep in mind when shopping around for a car loan.

The Eligibility Criteria for Car Loan

Like any other borrowing instrument, a car loan features a range of eligibility criteria, which takes into account your income level as well as your credit score. Your credit score (a 3 digit number between 300 and 900 that is included in your credit report), is in fact, an extremely crucial component of your application. A poor credit score in your report can easily derail your prospects of successfully applying for a car loan. So make sure you get a copy of your credit report, before you initiate the application process to ensure you get through the application process with ease. Some key documents that required when applying for a car loan are as follows:

Identity and address proof documents

Signature proof document

Income proof documents (salary slips/latest form 16/latest acknowledged ITR etc.)

Proof of business continuity /job security as per the requirements of the lender

Any other documents specified by the lender

This is just a short list of the documents required and there might be other documentation requirements specified by the prospective lender.

Car Loan Amount, Interest Rate and Tenure

The car loan amount disbursed is affected by various factors such as the income level and credit score of the applicant as well as the repayment capacity as calculated by the bank. Therefore, though the amount may vary from one lender to another, most car loan providers sanction amounts up to 50 lakhs with the actual total disbursement not exceeding 80% of the showroom price of the car.

Due to the high competition in the car loans segment, these loans often feature starting rates as low as 9.65%. However, the interest rate charged to your application is bound to be affected by criteria such as the loan amount disbursed, your credit score, the tenure of the loan, prior relationship (existing account/loans) with the lender as well as other factors.

The minimum tenure of a car loan is 12 months and in case of most lenders, the maximum tenure does not exceed 5 years. However, some lenders do allow car loan tenures of up to 7 years or more in case the total loan disbursed exceeds a specified level. Note: Long loan tenure decreases your individual EMI payments however; it also increases your absolute payout over the entire loan tenure, as you pay more interest on the principal.

Source: This Article.

Up Next:

In the next chapter, find out all about Foreign Exchange and the importance it holds a a banking product.

Please

Login

to Discuss

Don't Miss Out!

JOIN THEM NOW

ALL COURSES

ALL COURSES  LIVE CHATS

LIVE CHATS  EXPERTS

EXPERTS  MY CERTIFICATES

MY CERTIFICATES  ABOUT

ABOUT  SUPPORT

SUPPORT

DISCUSS