( 2 min )

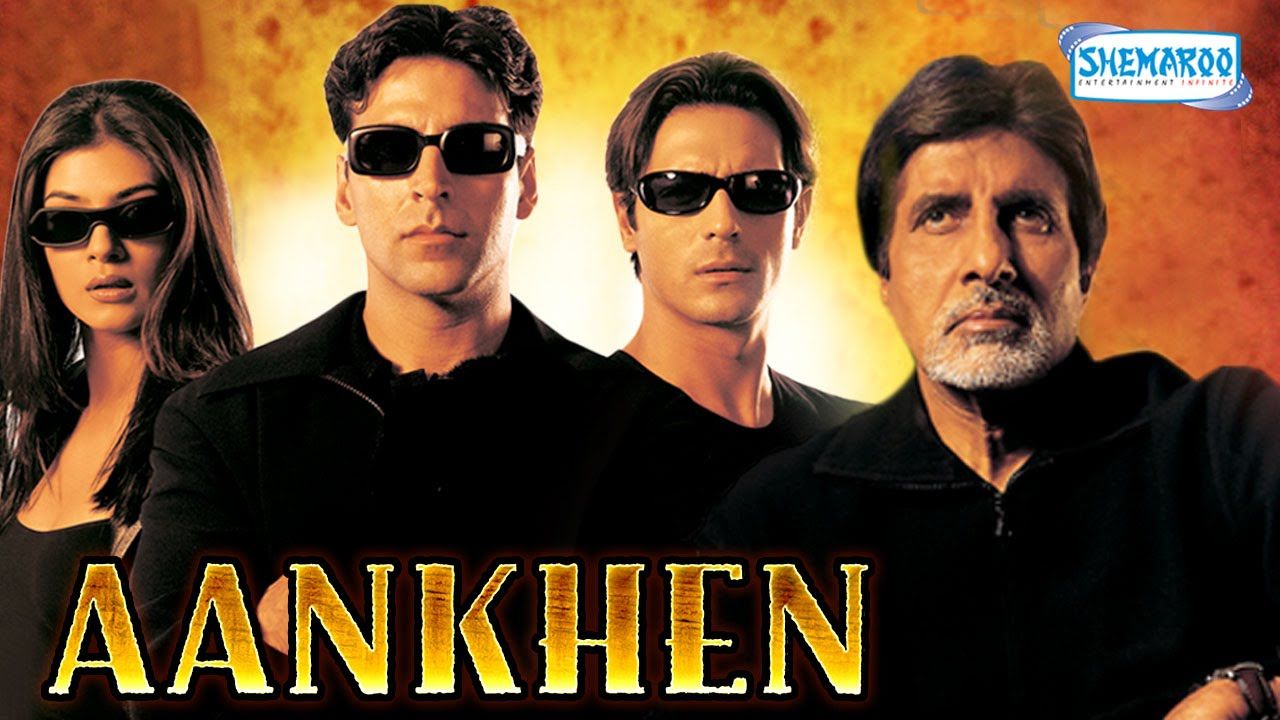

In the movie, Aankhen, starring Amitabh Bachchan, Akshay Kumar, Arjun Rampal and Paresh Rawal, a fired bank manager employs 3 blind men to loot a bank. He wants to avenge the people who robbed him of his job with his beloved Vilasrao Jefferson Bank by destroying the reputation of the bank and robbing all its deposits. That he employs 3 blind men to do it is the perfect ploy because no one would suspect blind men to be able to loot a bank. In a reversal of fortunes, the blind men turn on the fired bank manager, and manage to pin the blame for the robbery on him.

But what is it about a bank that its reputation will be destroyed if there is a robbery there?

Why is there so much money in a bank and whose money is it?

Why is it so difficult to loot a bank and hence why is it so unbelievable that 3 blind men can do it?

These are the questions we will begin with to understand what is a bank. While interest is the main idea on which an economy runs, a bank is the main institution that runs it.

So, what is a bank?

A bank is a Government approved and monitored institution that accepts deposits and issues loans to common people, adhering to a strict set of rules and procedures which are imposed uniformly and consistently.

After a hard day's work, we all want to keep the money we have earned in the safest possible manner. We would think that the closer we keep it to us, under the pillow at night and inside a safe in the day, the safer it will be. In reality, our homes don’t have the necessary infrastructure to safeguard our valuables like money and jewelry. Our homes are susceptible to crime, natural calamities and accidents. The purpose of a home is to provide material comfort and safety to individuals, not to money.

A bank is set up with the sole purpose to safeguard money. You can open an account in a bank and deposit your money there as and when you earn something. The money is received and kept by the bank very safely in its premises with special safes to protect any harm to them. You can withdraw the money as and when the need arises to fulfill your requirements and let the rest remain in your account. What's more, you also earn periodical interest on the principle you have kept in your account.

The bank in turn also loans out this money to people to support their business, agriculture and other needs. Thus the bank acts as a lender as well. Unlike a moneylender, the bank has fairer terms and also more reliable services.

Say a bank offers 5% interest for the deposits one makes to it and it charges 8% interest for the loans it gives out. The difference of 3% between the two rates is what a bank earns for the services it provides.

What's more, banks also provide safe deposit vaults where you can keep your jewelry and other valuables. The key to your vault remains only with you and the bank and no one can access it without your permission.

Types of Banks

Commercial Banks - These banks are the most popular form of banks. They accept deposits and offer short term loans.

Investment Banks - These banks also make investments in various markets and issue instruments. We shall elaborate on them further in latter chapters.

Central Bank - Every country has one central bank (Reserve Bank of India in our case) that monitors all the other banks working in the country. They issue currency, set interest rates and issue guidelines on how banks are expected to transact business. The Central Bank is the apex body which drives the banking system in a way that is beneficial to the common man and supports his various economic pursuits.

In India, two types of banks operate which are differentiated on the basis of their ownership. There are nationalized banks which are owned by the Government and there are private banks owned by individuals and corporates.

Up Next

In the next chapter, find out about the basic banking products, starting with different kinds of accounts and their properties.

Please

Login

to Discuss

Don't Miss Out!

JOIN THEM NOW

ALL COURSES

ALL COURSES  LIVE CHATS

LIVE CHATS  EXPERTS

EXPERTS  MY CERTIFICATES

MY CERTIFICATES  ABOUT

ABOUT  SUPPORT

SUPPORT

DISCUSS