What Are The Types Of Bank Accounts?

( 11 min )

Types of Bank Accounts:

There are various types of bank accounts that one can open as per their requirements. The basic types of bank accounts are listed below:

Savings Account

This account, as the name suggests, is for individuals who want to keep their savings safely and occasionally withdraw some money as and when required. The number of withdrawals you can do per month are limited and you earn reasonable interest on the amount deposited. This is the most basic form of investment one should make from his savings. Savings accounts can be of different types like a kids' savings account, senior citizens' savings accounts, women's savings accounts, etc.

Benefits of such a savings account may include an exclusive debit card, access to the network of ATMs across the nation, netbanking access, offers to save, invest, pay or shop as well as special offers like maintenance fees waived off for a period of time. There may be a minimum balance requirement before you can open a savings account wit most banks. Let's understand how an RM (relationship manager) at a bank will sell a savings account to a client.

NRE/ NRO Accounts

Many NRIs are often faced with the situation of maintaining a Rupee account in India. NRI has the option of opening a Non Resident Rupee (NRE) account and/or a Non Resident Ordinary Rupee (NRO) account. An NRO account can also be opened by a Person of Indian Origin (PIO) and an Overseas citizen of India (OCI).

Both accounts can be opened as Savings as well as current accounts and are Indian Rupee accounts. One needs to maintain an average monthly balance of Rs 75000 in both NRE and NRO accounts.

The Differences between NRE and NRO accounts:

1. Repatriation: NRE account is freely repatriable (Principal and interest earned) while the NRO account has restricted repatriability i.e permitted remittance allowed from NRO is up to USD 1 million net of applicable taxes in a financial year after giving undertaking along with a certificate from a chartered accountant.

2. Tax Treatment: NRE account is Tax free (no Income tax, wealth tax and gift tax) in India. On the other hand the interest earned in NRO account and credit balances are subject to respective income tax bracket and are also subject to applicable wealth and gift tax.

3. Deposit of Rupee funds generated in India: If an NRI/PIO/OCI is earning income originating in India (such as salary, rent, dividends etc.) he/she is only allowed to deposit it in NRO account. Deposit of such earnings is not permitted in NRE account.

4. Joint Holding: NRE account can be iointly held with another NRI but not with resident Indian. On the other hand NRO account can be held with NRI as well as resident Indian (close relative) as defined under Section 6 of the Companies Act 1956.

Choose NRE accounts if you:

want to park your overseas earnings remitted to India converted to Indian Rupees

want to maintain savings in Rupee but keep them liquid

want to make a joint account with another NRI

want Rupee savings to be freely repatriable

Choose NRO account if you:

want to park India based earnings in Rupees in India;

want account to deposit income earned in India such as rent, dividends etc;

want to open account with resident Indian (close relative)

Source: This Article.

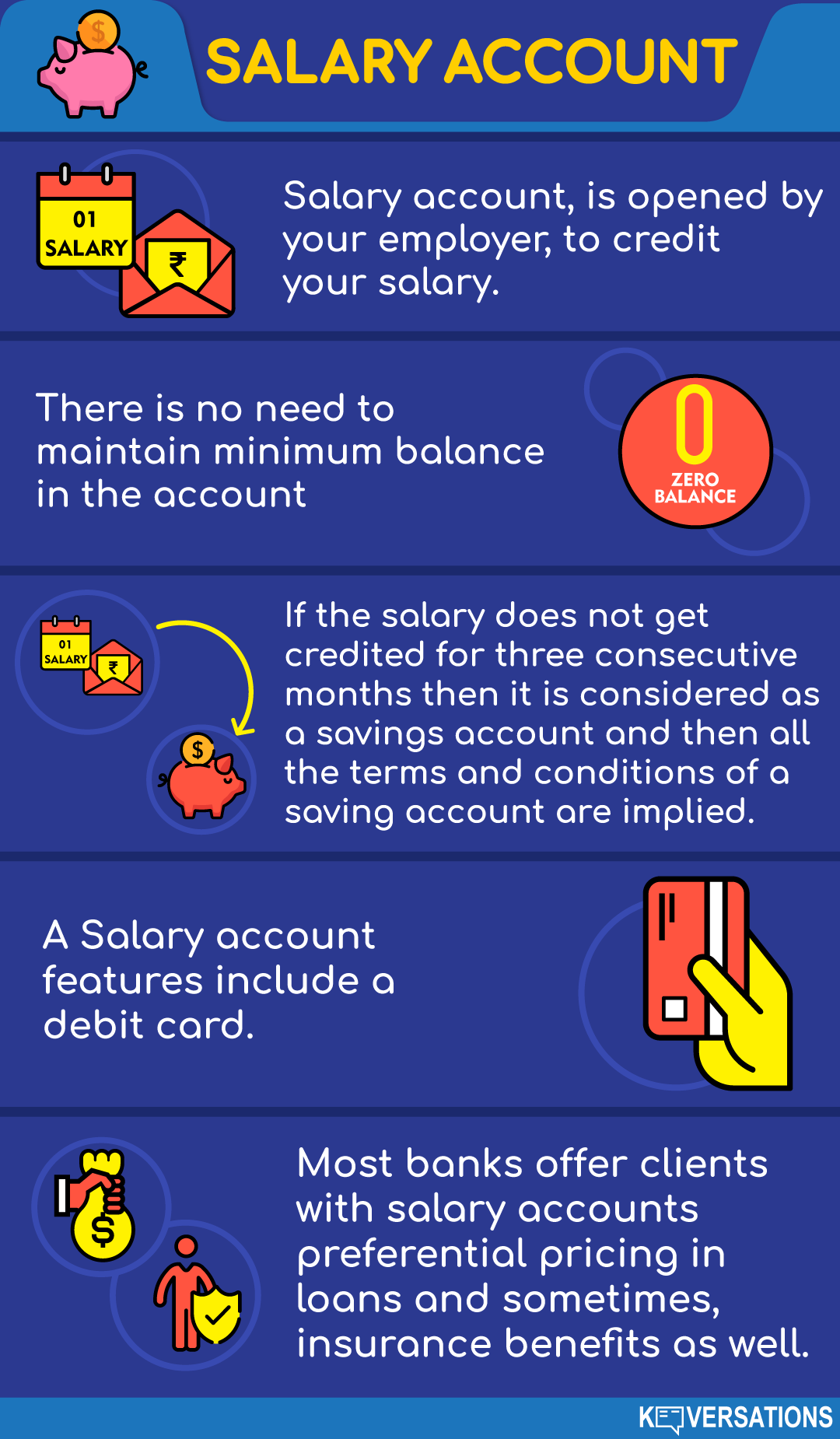

Salary Account

While a savings account is an interest-bearing deposit account held at a bank or another financial institution that provides a modest interest rate, a salary account is slightly different. Many people out there think how a salary account is different from a savings account as all the features of them are similar but still are two different accounts.

Banks or financial institutions may limit the number of withdrawals you can make from your savings account each month, and they may charge fees unless you maintain a certain average monthly balance in the account. Salary account, on the other hand, is the account opened by your employer for whom you work or provide your services, to credit your salary.

This account is designed for people from the salaried class. Generally, this account is such that there is no need to maintain minimum balance in the account hence it is similar to a zero balance account. However, one should remember that if the salary does not get credited for three consecutive months then it is considered as a savings account and then all the terms and conditions of a saving account are implied.

A salary account features include a debit card, and a zero balance account, as mentioned earlier. Most banks offer clients with salary accounts preferential pricing in loans and sometimes, insurance benefits as well.

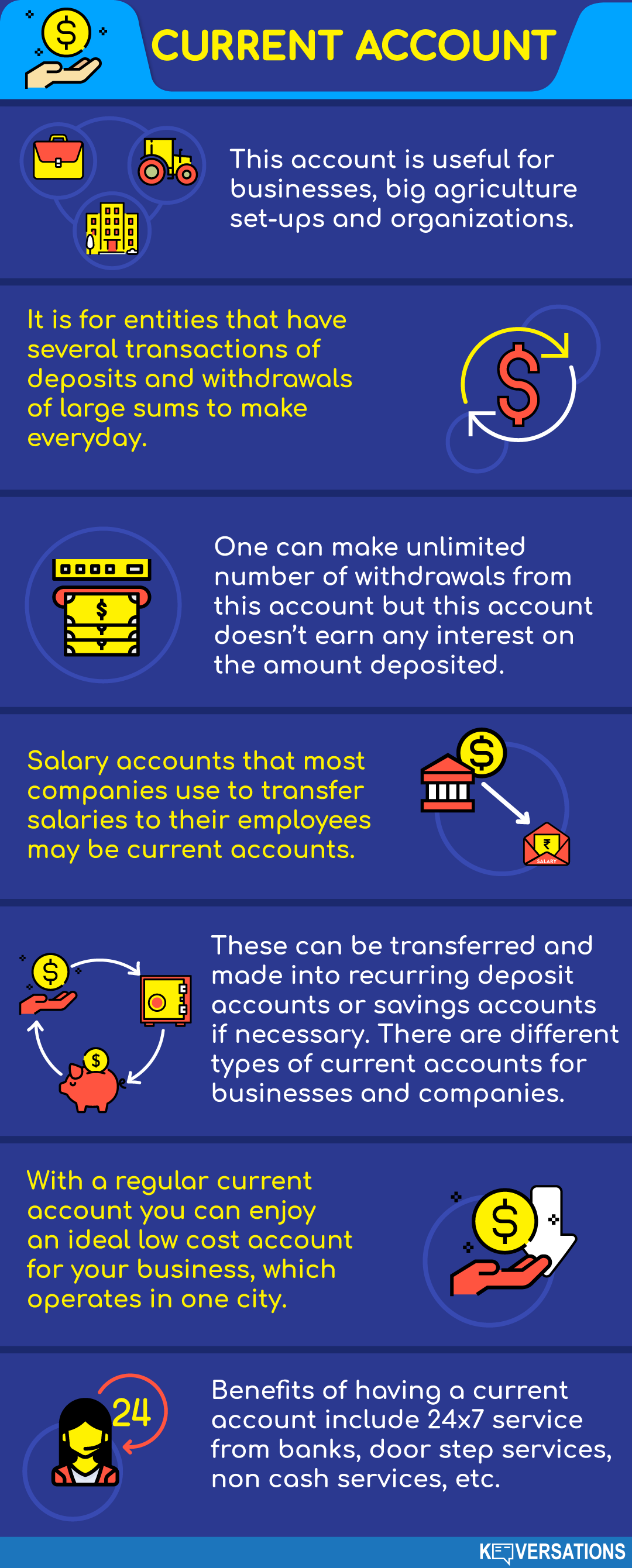

Current Account

This account is useful for businesses, big agriculture set-ups and organizations. It is for entities that have several transactions of deposits and withdrawals of large sums to make everyday. One can make unlimited number of withdrawals from this account but this account doesn’t earn any interest on the amount deposited. Salary accounts that most companies use to transfer salaries to their employees may be current accounts. Depending on the account holder's discretion though, these can be transferred and made into recurring deposit accounts or savings accounts if necessary.

There are different types of current accounts for businesses and companies. With a regular current account you can enjoy an ideal low cost account for your business, which operates in one city. Benefits of having a current account include 24x7 service from banks, door step services, non cash services, etc.

Fixed Deposit

If you aren't going to need a certain amount of money and you want to keep it safely for a long period of time then Fixed Deposit is the best account for you. Here you can't make withdrawals for long periods but you earn a fairly high amount of interest. It is ideal for long term planning.

How to operate of a bank account?

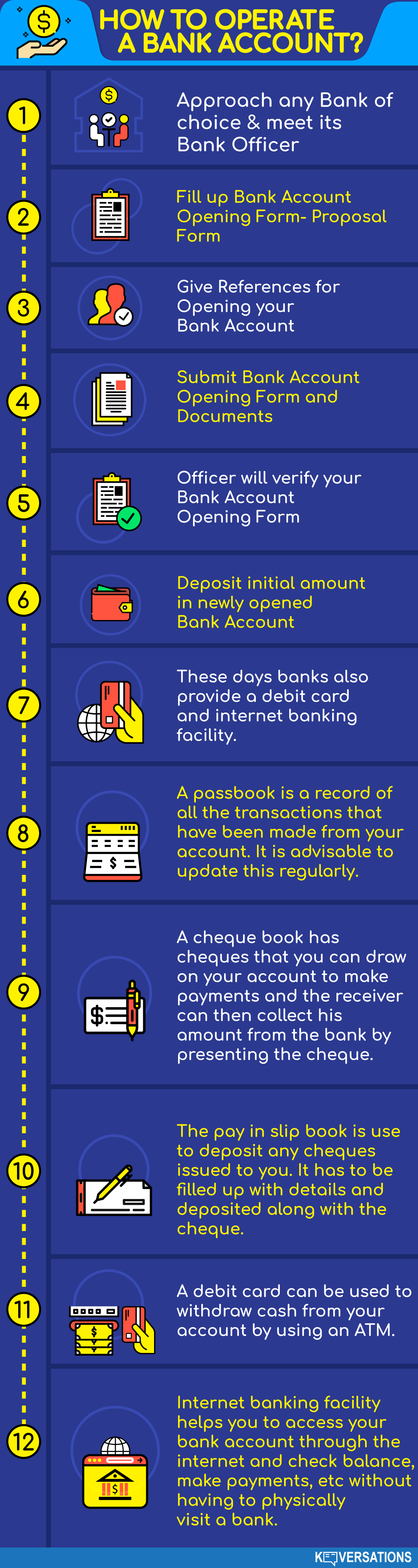

Approach any Bank of choice & meet its Bank Officer

Once the type of account is decided, the person should approach a convenient bank. He has to meet the bank officer regarding the opening of the account. The bank officer will provide a proposal form (Account Opening Form) to open bank account.

Fill up Bank Account Opening Form - Proposal Form

The proposal form must be duly filled in all respects. Necessary details regarding name, address, occupation and other details must be filled in wherever required. Two or three specimen signatures are required on the specimen signature card. If the account is opened in joint names, then the form must be signed jointly. Now-a-days the banks ask the applicant to submit copies of his latest photograph for the purpose of his identification.

Give References for Opening your Bank Account

The bank normally requires references or introduction of the prospective account holder by any of the existing account holders for that type of account. The introducer introduces by signing his specimen signature in the column meant for the purpose The reference or introduction is required to safeguard the interest of the bank.

Submit Bank Account Opening Form and Documents

The duly filled in proposal form must be submitted to the bank along with necessary documents. For e.g. in case of an individual, the application form must accompany with PAN card/ ration card to open the account.

Officer will verify your Bank Account Opening Form

The bank officer verifies the proposal form. He checks whether the form is complete in all respects or not. The accompanying documents are verified. If the officer is satisfied, then he clears the proposal form.

Deposit initial amount in newly opened Bank Account

After getting the proposal form cleared, the necessary amount is deposited in the bank. After depositing the initial , the bank provides a passbook, a cheque book and pay in slip book in the case of savings account. In the case of fixed deposits, a fixed deposit receipt is issued. In the case of current account, a cheque book and a pay in slip book is issued.

These days banks also provide a debit card and internet banking facility.

A passbook is a record of all the transactions that have been made from your account. It is advisable to update this regularly.

A cheque book has cheques that you can draw on your account to make payments and the receiver can then collect his amount from the bank by presenting the cheque.

The pay in slip book is used to deposit any cheques issued to you. It has to be filled up with details and deposited along with the cheque.

A debit card can be used to withdraw cash from your account by using an ATM. There are thousands of ATMs in every city and town and it is the most convenient way to withdraw cash as well as make payments in some places. Your debit card comes with a 4 digit pin which you should not reveal to anybody as it is like a password to your bank account.

Internet banking facility helps you to access your bank account through the internet and check balance, make payments, etc without having to physically visit a bank. In today's times, knowing how to operate internet banking is a very useful skill and will save a lot of your time and effort.

While in Aankhen the bank is successfully looted, in real life such instances are extremely rare. The Government has put in efforts to make banks available in every corner of our country as they will enable all of us to partake in our nation's prosperity. Every family member should have a bank account as it gives you access to safety, subsidy, support and prosperity. It's almost as important for an adult as a vaccination is important for a child.

Up Next:

In the next chapter, find out all about loans.

Please

Login

to Discuss

Don't Miss Out!

JOIN THEM NOW

ALL COURSES

ALL COURSES  LIVE CHATS

LIVE CHATS  EXPERTS

EXPERTS  MY CERTIFICATES

MY CERTIFICATES  ABOUT

ABOUT  SUPPORT

SUPPORT

DISCUSS